Introduction:

Investment plans for children generally aim to secure their financial future, such as education expenses or other milestones, this blog will discuss the 10 best investment plans that will make your children rich.

In today’s digital age, managing finances has become more accessible than ever before. The right financial tools can help you make informed decisions, stay organized, and achieve financial stability. Whether you’re looking to budget better, invest smarter, or plan for retirement, these tools will empower you to take control of your financial future. Start using them today, and take the first step towards financial independence.

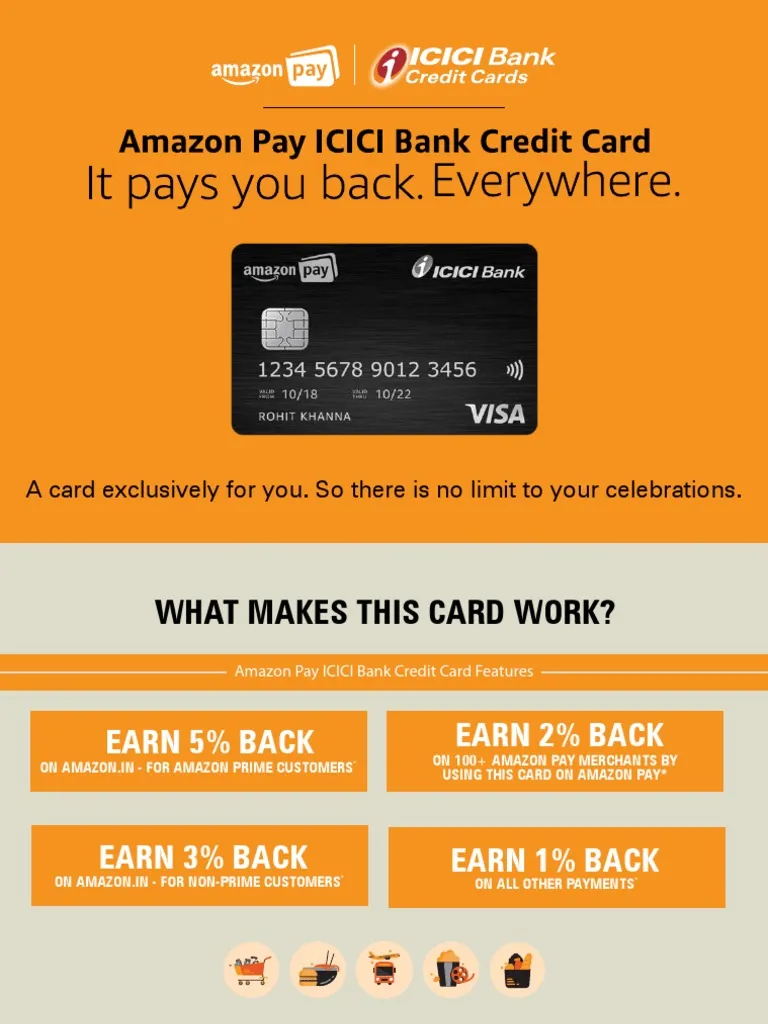

1. Get Them a Credit Card as Soon as They’re Born :

Yes you heard it right, when your child is born you could set them up as authorised user on your credit card. Since their name is attached to the card when you make purchases and pay the bill off on time you will also be building their credit score. So by the time they finish school they already got a good credit record. You have to be very careful with this investment idea because if you don’t pay bills on time you are going to give them a bad credit score. Its a great option to look into when choosing the best investment plans for your children future.

You can check our blog “3 best cashback credit cards” or “5 best credit cards from SBI“.

Please note: This information is for general purposes only and does not constitute financial advice. It is important to carefully consider your individual needs and financial situation before applying for any credit card. Always compare different cards and their terms and conditions before making a decision.

2. Open a PPF [Public Provident Fund Account] for your child :

To provide tax-free investment returns and establish a long-term fund for the child’s future expenses. Making good use of the tax benefits granted by the 1961, Income Tax Act’s section 80C. Under the PPF scheme, 2019 there is no restriction on any of the parent or both the parents contributing to the PPF account of a minor child.

An individual can contribute not more than Rs 1.5 lakh to his PPF account as well as to the PPF accounts of the minor/s taken together. The current PPF interest rate is 7.1% (Q2 of FY 2024-25), the minimum investment tenure is fixed at 15 years while the investment amount can range between Rs. 500 to Rs. 1.50 lakh in a financial year.

Invest and enjoy the power of compounding interest. Its a great option to look into when choosing the best investment plans for your children future.

Note: All the investments are subjected to market risk and should be done only after reading all documents.

3. Open a Demat account for minors :

As a parent who want to invest in shares in the name of their kids, opening a Demat account is the ultimate option. For this, they need to open a demat account for their minor child.

There is no minimum age restriction for opening a demat account for a minor. There are multiple platforms to choose from like : ZERODHA, GROWW , ANGEL ONE etc.

4. Start a SIP [Systematic Investment Plan] :

Systematic Investment Plan or SIP is a method of investing in mutual funds wherein an investor chooses a mutual fund scheme and invests the fixed amount of his choice at fixed intervals.

SIP investment plan is about investing a small amount over time rather than investing one-time huge amount resulting in a higher return.

You can choose the right Mutual Fund scheme and amount as per your best suited needs. Its a great option to look into when choosing the best investment plans for your children future.

Note: All the investments are subjected to market risk and should be done only after reading all documents.

5. Invest in Real estate:

Investment in property is another good investment option once can look into if you ample saving and have a good credit score to take up a home loan and buy a property in your child’s name. This will help your child generate passive income later in their life. Its a great option to look into when choosing the best investment plans for your children future.

You can invest in real estate through various ways:

- Traditional/Conventional Investment Model

The simplest way to invest in real estate is to buy or lease an asset for the long term and then rent it out to tenant–residential or commercial.

Renting Out a Portion of Your Existing Property

Even if you do not want to be burdened with significant investment costs outright, you can start as small as renting a room to commercial or residential tenants. If you have a whole floor of your current house lying unused, it is a better idea to rent it out.

Fix-and-Flip

This investing mode has been gaining popularity among people with experience in general contracting.

Investing in real estate via ETFs, mutual funds, and REITs

Such an investment in real estate can be clubbed into a similar category. Exchange-traded funds (ETF) and mutual funds can be bought that are themselves invested in real estate. Buying ETFs that invest in real estate stocks, such as publicly-traded home builds, is possible.

6. Invest in travel:

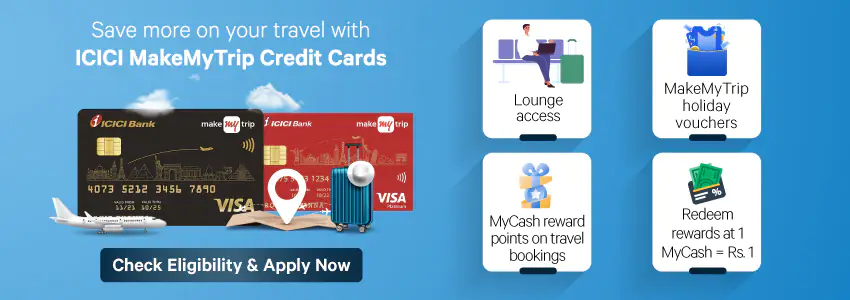

The more interesting and engaging someone is the more people want them in their venture because they can share stories, experiences, different food, languages. Children who travel are often more mature, independent and empathetic which can make a cornerstone of great networking skill. You can choose best suited credit card that give maximum benefits on travel deals. One such card is Makemytrip signature credit card from ICICI Bank.

- Get Rs 1,500 My Cash plus Complimentary MMTBLACK Exclusive membership, plusMakeMyTrip holiday voucher worth Rs 2,500 on joining.

- Get exclusive MMT Cabs benefit and a complimentary Airtel international roaming pack

- Enjoy complimentary international and domestic airport lounge access# and domestic railway lounge access.

- Get an extended validity of 1.5 years^ on Joining Benefit My Cash

7. ULIP Plans for Child Education:

In a world full of uncertainties, securing the future of children by providing them with the best education is a priority for parents. ULIP Plans for Child Education are schemes offering dual benefits of insurance plans and capital-building investments. This will help you to create a financial net for the most important stage i.e. education for your child.

A ULIP child education plan provides a policyholder with life coverage and capital investment opportunities in market-linked securities. The corpus generated through these investments can be utilized to fund the educational expenses of your child. Its a great option to look into when choosing the best investment plans for your children future.

Tax Exemptions:

Section 80C : Tax exemptions on premiums paid in ULIP Plan up to Rs. 1.5 lakhs annually.

Section 80E: Tax exemption for 8 years on interest paid for education loan.

Section 10 (10D): Tax exemption on the maturity amount (except in case of death benefits) if the net premiums paid annually from all ULIP plans is up to Rs. 2.5 Lakhs (limit of Rs. 2.5 lakhs was introduced in Union Budget 2021).

Note: All the investments are subjected to market risk and should be done only after reading all documents.

8. Teach them the value of Money:

The value of money is about helping them to understand effort and reward. You show them the effort that goes into making money, you help them to understand the importance of delayed gratification and to see the differences between wants and needs. Teaching them the value of money is also about showing them the importance of sharing and caring.

9. Introduce them to different career options:

In the final year of school you need to expose your child to different options and paths, and allow them to explore the areas that they enjoy, then you support their choices so they become the best at it . They can choose the path that suits their passion and strength, and those who do the thing they love are more likely to excel.

10. Encourage Their Entrepreneurial Spirit:

In today’s rapidly evolving world, the ability to think creatively, solve problems, and adapt to change is more valuable than ever. Fostering an entrepreneurial spirit in your child not only equips them with these essential skills but also instills confidence, resilience, and a proactive mindset. Whether they eventually start their own business or apply entrepreneurial thinking in other areas of life, encouraging this spirit from a young age can set them on a path to success. Here’s how you can help nurture the entrepreneurial potential in your child.

Conclusion:

Choosing the right financial tools can help you make informed decisions, stay organized, and achieve financial stability for your children. Whether you’re looking to budget better, invest smarter, or plan for children’s education, these tools will empower you to take control of your children’s financial future. Start using them today, and take the first step towards financial independence for you and your child. This blog hopefully helped you choose the right investment plan from the list of best investment plans for your children list.